Get the free dp11a form

Show details

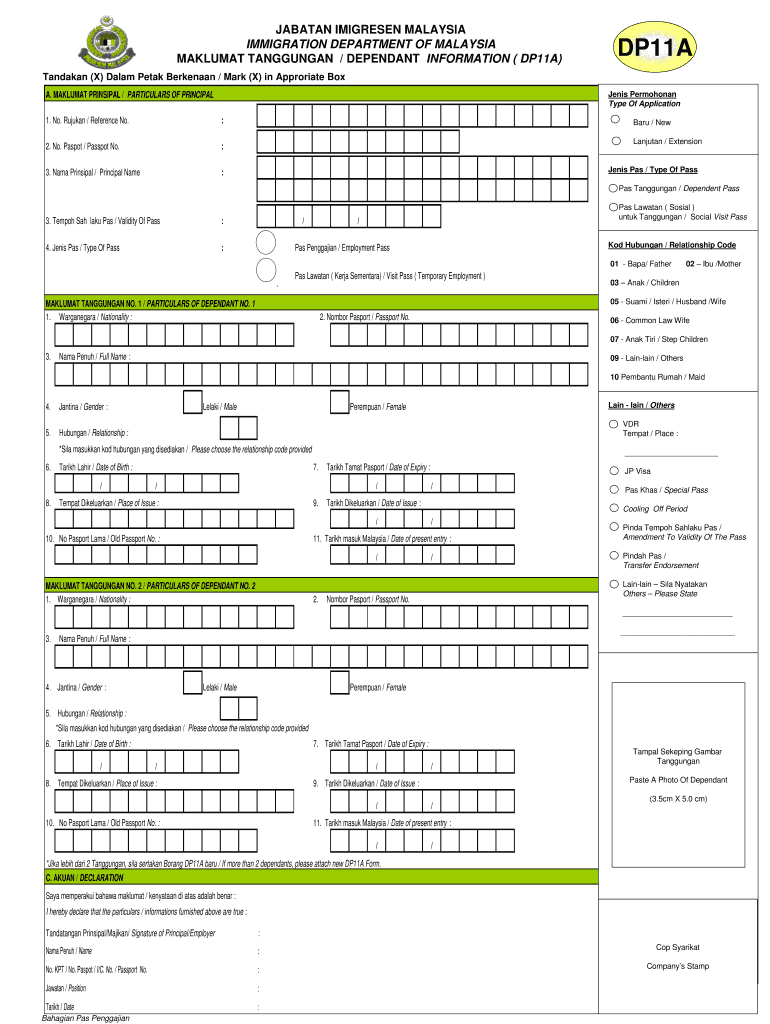

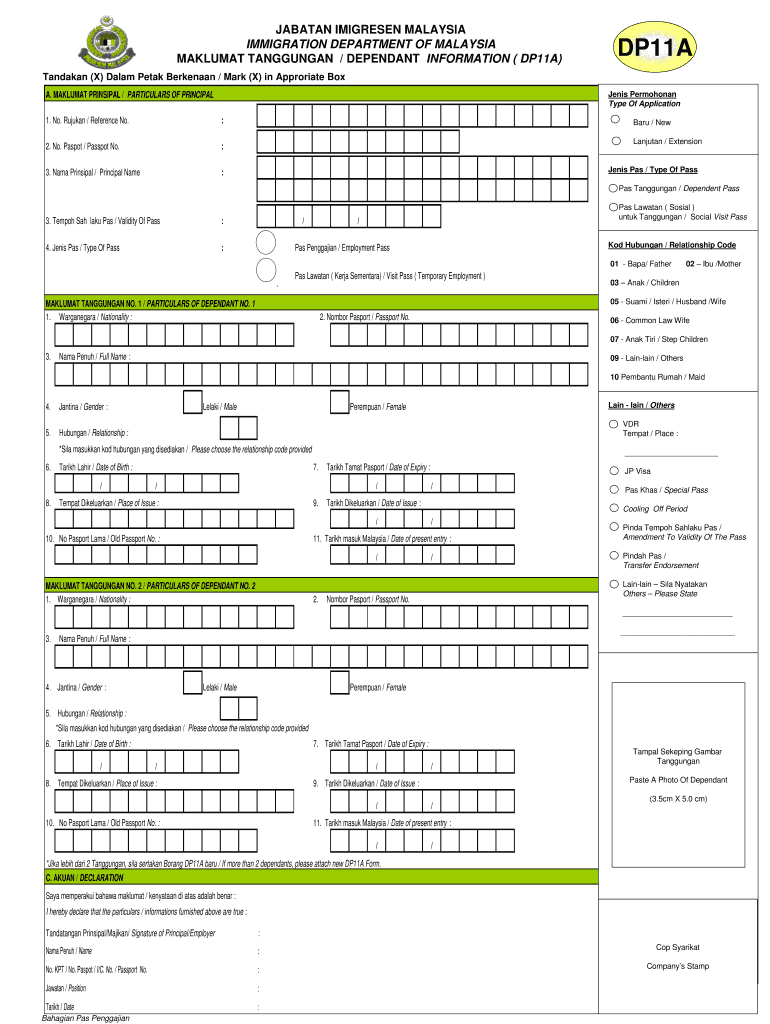

5cm X 5. 0 cm Jika lebih dari 2 Tanggungan sila sertakan Borang DP11A baru / If more than 2 dependants please attach new DP11A Form. C. JABATAN IMIGRESEN MALAYSIA IMMIGRATION DEPARTMENT OF MALAYSIA MAKLUMAT TANGGUNGAN / DEPENDANT INFORMATION DP11A DP11A Tandakan X Dalam Petak Berkenaan / Mark X in Approriate Box A. MAKLUMAT PRINSIPAL / PARTICULARS OF PRINCIPAL Jenis Permohonan Type Of Application 1. No* Rujukan / Reference No* 2. No* Paspot / Passpot No* 3. Nama Prinsipal / Principal Name...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your dp11a form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your dp11a form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing dp11a form online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit dp11a form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

How to fill out dp11a form

How to fill out borang dp11:

01

Start by filling in your personal information, such as your name, address, and contact details.

02

Move on to the section that requires details about your employment, including your company name, position, and salary information.

03

Provide information about your immigration status, such as your passport number and visa details.

04

Next, fill in the details about your dependent family members, if applicable.

05

Complete the declaration section by signing and dating the form.

06

Make sure to review all the information you have provided before submitting the form.

Who needs borang dp11:

01

Borang dp11 is typically required by foreign workers who are seeking employment in a specific country.

02

It is also necessary for individuals who are applying for a work permit or visa to legally work in another country.

03

Employers may also need to fill out borang dp11 when sponsoring a foreign worker for employment in their company.

Fill dp11a form expats : Try Risk Free

People Also Ask about dp11a form

What is DP11?

What is the special pass work permit Malaysia?

How much is the transfer of endorsement fee in Malaysia?

How much is Malaysia special pass?

How can I get special pass in Malaysia?

How do I cancel my Malaysia Employment Pass?

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is borang dp11?

Borang DP11 is a form required by the Malaysian Immigration Department for foreigners who are applying for a Social Visit Pass to Malaysia. The form is used to provide the Immigration Department with information about the applicant, such as their name, passport details, purpose of visit, and proposed duration of stay. The form must be completed and submitted along with the relevant supporting documents in order to be considered for a Social Visit Pass.

Who is required to file borang dp11?

Borang DP11 is a form required for filing income tax returns in Malaysia. It is required to be filed by all individuals with taxable income in Malaysia.

How to fill out borang dp11?

Borang DP11 is a form used to apply for the permission to travel abroad. In order to fill out this form, follow the steps below:

1. Enter your name, address, NRIC number, and passport number.

2. Select the type of travel you are applying for, such as a business trip, vacation, or study abroad.

3. Enter the name of the country you are travelling to, as well as the proposed dates of departure and return.

4. Provide the details of your travel companion, if applicable.

5. Provide the details of your sponsor, if applicable.

6. Enter the details of your proposed accommodation.

7. Provide details of your intended activities while abroad.

8. Answer the questions at the end of the form regarding your ability to cover the cost of your trip, any past travel violations, and any other information that may be relevant.

9. Sign the form.

Once you have completed the form, submit it to the relevant Malaysian embassy or consulate for processing.

What is the purpose of borang dp11?

The purpose of Borang DP11 is to apply for a work permit in Malaysia. It is issued by the Immigration Department of Malaysia and is required for foreign nationals who wish to work in the country. This form allows individuals to submit their personal and employment information, along with necessary documents, to obtain a valid work permit and legally work in Malaysia.

What information must be reported on borang dp11?

The Borang DP11, also known as the Expatriate Personal Income Tax Form, is used in Malaysia to report the income earned by expatriates. The information that must be reported on Borang DP11 includes:

1. Personal information: Name, passport number, tax file number, address, and employment details.

2. Income details: Total income earned during the tax year, including salary, bonuses, allowances, commissions, and any other forms of remuneration.

3. Tax deductions and exemptions: Any deductions or exemptions that the expatriate is eligible for, such as costs related to housing, education, medical expenses, and professional fees.

4. Tax reliefs: Any tax reliefs that the expatriate is entitled to, such as for donations to charitable organizations, medical expenses, or pension contributions.

5. Tax computation: Calculation of the total taxable income, tax rate applied, and the final tax payable or refundable.

6. Supporting documents: Relevant supporting documents, such as employment contract, salary statements, and receipts for deductions or reliefs claimed, should be attached to the Borang DP11.

It is important to consult the Malaysian tax authority or a qualified tax professional to ensure proper completion of the Borang DP11 and compliance with tax regulations.

What is the penalty for the late filing of borang dp11?

The penalty for late filing of Borang DP11 (income tax return form for non-resident individuals) is as follows:

1. Late filing fee: A fee of RM200 will be imposed for each year the form is filed late.

2. Additional tax: If the form is filed late and there is income tax payable, an additional 10% of the tax amount will be added to the total tax payable.

It's important to note that these penalties may vary and are subject to change, so it's essential to consult the relevant tax authorities or professional advisors for the most up-to-date information.

How do I modify my dp11a form in Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your dp11a form along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

How can I send borang dp11a to be eSigned by others?

When you're ready to share your borang dp11, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

Can I edit dp11 form on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as form dp 11a. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

Fill out your dp11a form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Borang dp11a is not the form you're looking for?Search for another form here.

Keywords relevant to dp11a information form

Related to maklumat form template

If you believe that this page should be taken down, please follow our DMCA take down process

here

.